UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | x | ||

| Filed by a Party other than the Registrant | o |

Check the appropriate box:

x | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under §240.14a-12 |

MYR Group Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | ||||

No fee required. | ||||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

TablePRELIMINARY COPY — SUBJECT TO COMPLETION

In accordance with Rule 14a-6(d) under Regulation 14A of Contentsthe Securities Exchange Act of 1934, please be advised that MYR Group Inc. intends to release definitive copies of the proxy statement to security holders on or about March 15, 2016.

![[GRAPHIC MISSING]](https://capedge.com/proxy/PRER14A/0001144204-16-086962/logo_myr-bk.jpg)

MYR GROUP INC.

THREE CONTINENTAL TOWERS1701 GOLF ROAD, SUITE 3-1012

ROLLING MEADOWS, IL 60008-4210

March 10, 2014[ ], 2016

Dear Fellow Stockholder:Stockholder,

I am pleased to invite you to attend the 20142016 Annual Meeting of Stockholders of MYR Group Inc., which will be held at 9:00 a.m. local time on Thursday, May 1, 2014,April 28, 2016, at the DoubleTree Hotel, 75 West Algonquin Road, Arlington Heights, Illinois 60005.60005 (the “Annual Meeting”). The meeting facilities will open to stockholders at 8:30 a.m. local time.

At the Annual Meeting we will report on operations and act on the matters described in the Notice of Annual Meeting of Stockholders and the Proxy Statement that follow this letter. Stockholders of record at the close of business on March 3, 2014,1, 2016, are entitled to notice of, and to vote at, the Annual Meeting.

It is important that your shares are represented and voted at the Annual Meeting regardless of the size of your holdings.PleaseEven if you intend to attend the Annual Meeting, please complete, sign, date and return the accompanying WHITE proxy card in the enclosed postage-paid envelope as soon as possible in order to ensure the presence of a quorum. If you do not vote promptly, we may incur additional costs in soliciting proxies. Voting by returning your proxy card in advance of the Annual Meeting does not deprive you of your right to attend and vote in person at the Annual Meeting.

You should know that Engine Capital, L.P. (“Engine Capital”) has stated that it intends to nominate a slate of three nominees for election as directors at the Annual Meeting in opposition to the nominees recommended by the board of directors of MYR Group Inc. (the “Board”). The Board does not endorse the election of any of Engine Capital’s nominees.

You may receive solicitation materials from Engine Capital or its affiliates, including a proxy statement and a [color] proxy card. We are not responsible for the accuracy of any information provided by or relating to Engine Capital or its nominees contained in solicitation materials filed or disseminated by or on behalf of Engine Capital or any other statements of Engine Capital.

The Board unanimously recommends that you voteFOR the election of each of our director nominees on the accompanyingWHITE proxy card. The Board strongly urges you not to sign or return any [color] proxy card sent to you by or on behalf of Engine Capital. If you have already returned a proxy card for Engine Capital, you can revoke that proxy by using the enclosedWHITEproxy card to vote your shares. Only your latest-dated proxy will count. The Board and management look forward to your participation at the Annual Meeting and appreciate your continued support.

| Sincerely yours, | ||

![[GRAPHIC MISSING]](https://capedge.com/proxy/PRER14A/0001144204-16-086962/sig_williama-koertner.jpg)

William A. Koertner

Chairman, President and Chief Executive Officer

YOUR VOTE IS IMPORTANT

Table of ContentsPRELIMINARY COPY — SUBJECT TO COMPLETION

MYR GROUP INC.

Three Continental Towers1701

Golf Road, SuiteGOLF ROAD, SUITE 3-1012Rolling Meadows,ROLLING MEADOWS, IL 60008-4210

60008

NOTICE OF 2014THE 2016 ANNUAL MEETING OF STOCKHOLDERS

OF MYR GROUP INC.

| TIME AND DATE: | 9:00 a.m. local time on Thursday, | |||

| PLACE: | DoubleTree Hotel 75 West Algonquin Road Arlington Heights, Illinois 60005 | |||

| ITEMS OF BUSINESS: | (1) | Election as directors of the | ||

(2) | Advisory resolution to approve the compensation of our named executive officers; | |||

(3) | ||||

Ratification of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, | ||||

(4) Consideration of other business properly presented at the meeting. | ||||

| BOARD RECOMMENDATION: | The Board of Directors recommends that you vote, by following the instructions on the enclosedWHITE proxy card,FORthe election of each of the nominees in Item 1 andFORItems 2 | |||

| WHO CAN VOTE: | Stockholders of record at the close of business on March | |||

| DATE OF DISTRIBUTION: | This Notice of Meeting, the Proxy Statement, the accompanyingWHITE proxy card and our |

Important Notice Regarding the Availability of Proxy Materials for our

20142016 Annual Meeting of

Stockholders to be held May 1, 2014

This Notice of Meeting, the Proxy Statement, and the 20132015 Annual Report to Stockholders on Form 10-K are available aton our websitehttp://investor.myrgroup.com/annuals.cfm.

![[GRAPHIC MISSING]](https://capedge.com/proxy/PRER14A/0001144204-16-086962/sig_geraldb-engen.jpg)

Gerald B. Engen, Jr.

Senior Vice President, Chief Legal Officer and Secretary

March [ ], 2016

TABLE OF CONTENTS

| ||||

March 10, 2014

SUMMARY INFORMATION | 1 | |||||||

CORPORATE GOVERNANCE | 3 | |||||||

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE MATTERS | 6 | |||||||

PROPOSAL NO. 1. ELECTION OF DIRECTORS | 8 | |||||||

| BACKGROUND OF SOLICITATION | 16 | |||||||

| SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | ||||||||

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS | ||||||||

COMPENSATION COMMITTEE MATTERS | ||||||||

DIRECTOR COMPENSATION | ||||||||

COMPENSATION DISCUSSION AND ANALYSIS | ||||||||

| EXECUTIVE COMPENSATION TABLES | 41 | |||||||

| PROPOSAL NO. 2. ADVISORY RESOLUTION TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | ||||||||

| AUDIT COMMITTEE MATTERS

| ||||||||

PROPOSAL NO. | ||||||||

| ||||||||

| ||||||||

| ||||||||

OTHER MATTERS THAT MAY BE PRESENTED AT THE ANNUAL MEETING | ||||||||

OWNERSHIP OF EQUITY SECURITIES | ||||||||

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING | ||||||||

| ||||||||

APPENDIX | INFORMATION REGARDING PARTICIPANTS IN MYR GROUP’S | |||||||

| ||||||||

| ||||||||

| ||||||||

Throughout this proxy statement, references to "MYR“MYR Group,"” the "Company," "we," "us,"“Company,” “we,” “us,” and "our"“our” refer to MYR Group Inc. and its consolidated subsidiaries, except as otherwise indicated or as the context otherwise requires.

i

MYR GROUP INC.

March 10, 2014

[ ], 2016

PROXY STATEMENT

FOR 2014THE 2016 ANNUAL MEETING OF STOCKHOLDERS

This Summary Information Sectionsection introduces the proposals to be voted on at the 20142016 Annual Meeting of Stockholders (the "Annual Meeting"“Annual Meeting”) as well as highlights of our corporate governance, executive compensation and business results in 2013.2015. We encourage you to review the entire 20142016 proxy statement (the "Proxy Statement"“Proxy Statement”) prior to determining how you wish to vote your shares. We are holding the Annual Meeting on Thursday, May 1, 2014April 28, 2016 at 9:00 a.m. local time at the DoubleTree Hotel, 75 West Algonquin Road, Arlington Heights, Illinois 60005.

Meeting Agenda and Voting Recommendation

| Item | Proposal | Board Vote Recommendation | Page Reference (for details) | |||

| 1. | Election as directors of the three nominees identified in this Proxy Statement and the enclosedWHITE proxy card, each to serve a term of three years | FOR EACH NOMINEE | 8 | |||

| 2. | Advisory resolution to approve the compensation of our named executive officers | FOR | 52 | |||

| 3. | Ratification of the appointment of Ernst & Young LLP (“EY”) as our independent registered public accounting firm for the year ending December 31, 2016 | FOR | 56 |

Item | Proposal | Board Vote Recommendation | Page Reference (for details) | |||

|---|---|---|---|---|---|---|

1. | Election as directors of the two nominees identified in this Proxy Statement, each to serve a term of three years | FOR EACH NOMINEE | 8 | |||

2. | Advisory resolution to approve the compensation of our named executive officers | FOR | 44 | |||

3. | Approval of the MYR Group Inc. 2007 Long-Term Incentive Plan (Amended and Restated as of May 1, 2014) | FOR | 46 | |||

4. | Approval of the MYR Group Inc. Senior Management Incentive Plan (Amended and Restated as of May 1, 2014) | FOR | 61 | |||

5. | Approval of an amendment to the MYR Group Inc. Restated Certificate of Incorporation (the "Certificate of Incorporation") to increase the maximum size of the Board | FOR | 66 | |||

6. | Ratification of the appointment of Ernst & Young LLP ("EY") as our independent registered public accounting firm for the year ending December 31, 2014 | FOR | 69 |

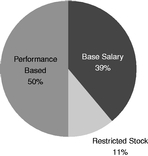

20132015 Executive Compensation Highlights

Our executive compensation program seeks to reward our executive officers for their contributions to our short-term and long-term performance. Most importantly, we seek to link individual pay to companyCompany success, and we work to structure executive officer compensation consistent with this goal. We

maintain the following policies and practices, among others, that aim to promote our commitment to pay-for-performance:pay for performance:

•- We provide our executive officers with total compensation opportunities at levels that we believe are competitive with our peer companies so that we can retain and motivate our skilled and qualified

officers;•- officers.

We grant equity awards under our Long-Term Incentive Plan (Amended and Restated as of May5, 2011) ("LTIP"1, 2014) (the “LTIP”)that, which includeboth retention-basedtime-based retention awards and awards that areintendedtied tomaximize stockholder value by rewarding achievementCompany performance goals or the performance oflong-termthe Company’s stock. Equity awards under the LTIP may be issued in the form of stock options, stock appreciation rights, restricted stock, performancegoals;awards, phantom stock, stock bonuses and•- dividend equivalents.

We annually put our named executive officer compensation to an advisory vote of our stockholders and received a positive response of over 97% of the votes cast on this proposal at our 2015 Annual Meeting.We include clawback provisions in our LTIP award agreements, which subject all new equity awards under the LTIP to theCompany'sCompany’s right to recover in the event that it is determined that a participant engaged in conduct that contributed to any material restatement of our earnings.2013 Business ResultsWehad strong financialcap annual cash incentive awards that can be earned at 200% of salary for our Chief Executive Officer (“CEO”) and lesser amounts for our other named executive officers. The number of performancein 2013 with improvement in several financial measures. Among someshares that can be earned is capped at 200% of target for all named executive officers.

•Our gross profit increased 5.2%a loan.

Code of Ethics and Corporate Governance Principles

We have a Code of Business Conduct and Ethics (the "Code“Code of Ethics"Ethics”) applicable to all of our directors, officers and employees. The Code of Ethics promotes honest and ethical conduct, full and accurate public communication and compliance with applicable laws, rules and regulations. We disclose any waiver or amendments to the Code of Ethics as required by the applicable rules of the U.S. Securities and Exchange Commission ("SEC"(“SEC”).

Additionally, the Boardboard of directors of MYR Group (the “Board”) has guidelines that provide a framework for MYR Group'sGroup’s corporate governance (the "Corporate“Corporate Governance Principles"Principles”). The Corporate Governance Principles assist the Board in the exercise of its responsibilities to help ensure compliance with governing law and our policies.

Stockholders and others can access our corporate governance materials, including the Certificate of Incorporation, Amended and Restated By-Laws ("By-Laws"(the “By-Laws”), Board committee charters, our Corporate Governance Principles, our Code of Ethics and other corporate governance related materials aton our website atwww.myrgroup.com. Copies of these materials are also available free of charge to any stockholder who sends a written request to our Secretary at MYR Group Inc., 1701 Golf Road, Suite 3-1012, Rolling Meadows, Illinois 60008-4210.60008.

The information on our website is not, and shall not be deemed to be, a part of this Proxy Statement or incorporated into any other filings we make with the SEC.

Director Independence

Our Corporate Governance Principles require that at least a majority of the Board qualify as independent directors under the listing standards of the NASDAQ Stock Market ("Nasdaq"(“Nasdaq”). and any other requirements of the committees upon which he or she serves. Nasdaq listing standards have both objective tests and a subjective test for determining who is an independent director. The objective tests state, for example, that an employee director is not considered independent. The subjective test requires the Board to affirmatively determine that the director does not have a relationship that would interfere with the director'sdirector’s exercise of independent judgment in carrying out his or her responsibilities. In addition, as described below under "Compensation Committee Matters" and "Audit Committee Matters," membersMembers of our CompensationAudit Committee and AuditCompensation Committee, respectively, are subject to certain additional independence criteria.criteria as described below under “Audit Committee Matters” and “Compensation Committee Matters.”

After considering the Nasdaq listing standards and information provided by each director, the Board determined that the following directors are independent: Jack L. Alexander, Larry F. Altenbaumer, Henry W. Fayne, BettyKenneth M. Hartwick, Gary R. Johnson, Gary R. Johnson,Donald C.I. Lucky, Maurice E. Moore and William D. Patterson. William A. Koertner is not considered an independent director due to his employment with MYR Group.

Executive Sessions of the Board

In accordance with the Corporate Governance Principles, the independent directors meet at least twice per year in executive sessions, which are chaired by the Lead Director. Executive sessions are typically held following Board meetings, without management present.

Meeting Attendance

We expect directors to regularly attend Board meetings and meetings of the committees on which they serve. The Board held ninetwenty-three meetings in 2013. All2015, seven of which were briefings by management on project bidding opportunities. For the year ended December 31, 2015, all of our directors attended at least 75%91% of the aggregate number of meetings of the Board and the committees on which they served. No director was unable to attend more than one meeting. All directors are expected to attend the Annual Meeting and

all directors serving at the time of the 20132015 Annual Meeting, of Stockholders, including the director nominees, attended that meeting.

Communications with the Board and Reporting of Concerns

The Board values and encourages constructive dialogue with stockholders and other interested parties on topics such as compensation and other important governance topics. Stockholders and other interested parties can communicate with the directors, individually or as a group, by writing to our Secretary at MYR Group Inc., 1701 Golf Road, Suite 3-1012, Rolling Meadows, Illinois 60008-421060008 or by submitting an e-mail to our corporate website athttp://investor.myrgroup.com/contactBoard.cfm.

The Secretary forwards communications relating to matters within the Board'sBoard’s purview to the appropriate directors, communications relating to matters within a Board committee'scommittee’s area of responsibility to the chair of the appropriate committee and communications relating to ordinary business matters, such as suggestions, inquiries and consumer complaints to the appropriate MYR Group officer. The Secretary generally does not forward complaints about service, new services suggestions, resumes and other forms of job inquiries, surveys, business solicitations or advertisements or inappropriate communications. Anyone who has a concern about the Company’s conduct, accounting, financial reporting, internal controls, or auditing matters may submit that concern anonymously or confidentially to the Company’s Anonymous Incident Reporting System — MySafeWorkplace — at 800-461-9330 orwww.mysafeworkplace.com.

Board Leadership Structure

Our Corporate Governance Principles provide that the Board is freehas the discretion to choose its board leadership structure and Chairman in any way that it deems best for MYR Group at any time.and our stockholders. When determining the leadership structure that allows the Board to effectively carry out its responsibilities and represent our stockholders'stockholders’ interests, the Board considers various factors including our specific business needs, our industries'industry’s demands, our operating and financial performance, the economic and regulatory environment, Board self-evaluations, alternative leadership structures and our corporate governance policies and practices. William A. Koertner currently serves as both Chairman of the Board and our Chief Executive Officer ("CEO").CEO. He has held both of those positions since 2007. The Board believes that combining the Chairman and CEO positions, together with an independent Lead Director, is appropriate at this time because it effectively utilizes Mr. Koertner’s extensive experience and knowledge of our industry and Company and provides for efficient leadership of our Board and Company. In making this determination, the Board has taken into consideration MYR Group’s size, structure and business as well as Mr. Koertner’s knowledge of the industry, successful tenure with MYR Group and his established relationships with our customers. The Board also believes that Mr. Koertner is in the best position to inform our independent directors about our operations, projects and issues important to the Company. Except for Mr. Koertner, the Board is comprised entirely of independent directors and all of the committee members are independent. The Board has the necessary power and authority to request and obtain information directly from management, to retain outside consultants and to consult directly with management and employees where it deems appropriate.

In accordance with the Corporate Governance Principles, the independent directors selected Gary R. Johnson to serve as the Board'sBoard’s Lead Director. As Lead Director, Mr. Johnson has the authority to call meetings of the independent directors and his duties include, among others, presiding at executive sessions of the independent directors, which are typically held following Board meetings without management present, and serving as a liaison between the Chairman and the independent directors and, where appropriate, with the stockholders.

The Board believes that combining the Chairman and CEO positions, together with an independent Lead Director, is appropriate at this time. In making this determination, the Board has taken into consideration MYR Group's size, structure and business as well as Mr. Koertner's knowledge of the industry, tenure with MYR Group and established relationships with the Board and our customers. Mr. Koertner is in the best position to inform our independent directors about our operations, projects and issues important to the Company. The Board has the necessary power and authority to request and obtain information directly from management, to retain outside consultants and to consult directly with management and employees where it deems appropriate. Our overall corporate governance policies and practices, combined with the strength of our independent directors, minimize any potential conflicts that may result from combined roles of Chairman and CEO. The Nominating and Corporate Governance Committee and the other independent directors periodically review this structure to ensure it is still appropriate.

Risk Oversight

We do not view risk in isolation but consider risk as part of our regular consideration of business strategy and business decisions. Assessing and managing risk is the responsibility of management, which establishes and maintains risk management processes, including action plans and controls, to balance risk mitigation and opportunities to create stockholder value. It is management'smanagement’s responsibility to anticipate, identify and communicate risks to the Board and/or its committees.

The Board overseeshas the responsibility to oversee and

reviews review certain aspects of our risk management efforts, either directly or through its committees.committees, based upon management’s identification, assessment and mitigation of risk. We approach risk management by integrating strategic planning and operational decision-making andwith risk oversight by management and communicating identified risks and opportunities to the Board. The Board commits extensive time and effort discussing and establishing the Company'sCompany’s strategic plan, and it reconsiders key elements of the strategic plan as significant events and opportunities arise during the year. As part of the strategic plan review, as well as in evaluating events and opportunities that occur during the year, the Board and management focus on the primary value drivers for the Company and risks forfacing the Company.

The Board'sBoard’s standing committees are each chaired by an independent director and support the Board'sBoard’s oversight functions by regularly addressing various risks in their respective areas of oversight. Specifically, the Audit Committee assists the Board in fulfilling its risk management oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls and compliance with public reporting requirements. The Compensation Committee assists the Board in fulfilling its risk management oversight responsibilities associated with risks arising from compensation policies and programs.programs, including the review of incentive compensation to ensure our programs contribute to our success, increase shareholder value and discourage unnecessary and excessive risk taking. The Nominating and Corporate Governance Committee assists the Board in fulfilling its risk management oversight responsibilities associated with risks primarily related to corporate governance. Each of the committee chairs reports to the full Board at regular meetings concerning the activities of the committee, the significant issues it has discussed and the actions taken by the committee.

We believe that our leadership structure supports the risk oversight function of the Board. WithAll directors are actively involved in the risk oversight function and with our CEO serving as Chairman of the Board, he is able to promote open communication between management and directors relating to risk. Additionally, each Board committee is chaired by an independent director and all directors are actively involved in the risk oversight function.

Committee Membership

Our Board designates the members and chairs of committees based on the Nominating and Corporate Governance Committee'sCommittee’s recommendations. Because he is not an independent director, William A. Koertner does not serve on any of the committees. The Board has three standing committees—committees — Audit, Compensation, and Nominating and Corporate Governance—Governance — each comprised entirely of independent directors. Membership of the committees in 20132015 was as follows:

Name | Audit | Compensation | Nominating and Corporate Governance | Audit | Compensation | Nominating and Corporate Governance | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Jack L. Alexander | X | X | — | X | X | — | ||||||||||||||||

Larry F. Altenbaumer | — | Chair | X | — | Chair | X | ||||||||||||||||

Henry W. Fayne | X | X | — | X | X | — | ||||||||||||||||

Betty R. Johnson | X | — | X | |||||||||||||||||||

| Kenneth M. Hartwick(1) | X | — | X | |||||||||||||||||||

| Betty R. Johnson(2) | X | — | X | |||||||||||||||||||

Gary R. Johnson | — | X | Chair | — | X | Chair | ||||||||||||||||

| Donald C.I. Lucky(1) | — | X | X | |||||||||||||||||||

Maurice E. Moore | X | — | X | X | — | X | ||||||||||||||||

William D. Patterson | Chair | X | — | Chair | X | — | ||||||||||||||||

| | | | | | | | ||||||||||||||||

Number of Meetings in 2013 | 5 | 5 | 2 | |||||||||||||||||||

| Number of Meetings in 2015 | 6 | 7 | 4 | |||||||||||||||||||

| (1) | Mr. Hartwick’s and Mr. Lucky’s appointments to the Board were effective on July 29, 2015. |

| (2) | Effective October 19, 2015, Ms. Johnson resigned from the Board and was appointed Senior Vice President, Chief Financial Officer and Treasurer. |

Each of the three standing committees has a written charter adopted by the Board. The charters define each committee'scommittee’s roles and responsibilities. The charters are available on our website atwww.myrgroup.com. MYR Group will provide copies of these charters free of charge to any stockholder who sends a written request to our Secretary at MYR Group Inc., 1701 Golf Road, Suite 3-1012, Rolling Meadows, Illinois 60008-4210.60008.

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE MATTERS

The Board has determined that all of the Nominating and Corporate Governance Committee members are independent under the Nasdaq listing standards. The primary responsibilities of the Nominating and Corporate Governance Committee include (i) identifying and recommending to the Board individuals qualified to serve as director, (ii) advising the Board with respect to the Board'sBoard’s size, composition, procedures and committees, (iii) developing and recommending to the Board the corporate governance principles applicable to the Company, (iv) overseeing the self-evaluation of the Board and Board committees and (v) providing oversight with respect to corporate governance and ethical conduct.

Criteria for Nomination to the Board of Directors and Diversity

CandidatesThe Board is responsible for nominationnominating directors for election to the Board are selected by theBoard. The Nominating and Corporate Governance Committee is responsible for identifying, screening, and recommending candidates to the Board for Board membership, in accordance with the committee'scommittee’s charter, our Certificate of Incorporation, our By-Laws, our Corporate Governance Principles and additional criteria that may be adoptedconsidered by the Board regarding director candidate qualifications. The Nominating and Corporate Governance Committee will evaluatealso evaluates the qualifications of all candidates properly nominated by stockholders — in the same manner and using the same criteria, regardless of the source of the recommendation.criteria.

Since the identification and selection of qualified directors is a complex and subjective process that requires consideration of many intangible factors, and will be significantly influenced by the particular needs of the Board from time to time, there is not a specific set of minimum qualifications, qualities or skills that are necessary for a nominee to possess, other than those that are necessary to meet legal requirements, the Nasdaq listing standards and the provisions of our Certificate of Incorporation, By-Laws, Corporate Governance Principles and charters of the Board'sBoard’s committees. When considering nominees, the Nominating and Corporate Governance Committee may take into consideration many factors including, but not limited to, a candidate's:candidate’s:

•- record of accomplishment in his or her chosen field;

•depth and breadth of experience at an executive, policy-making level in business, financial services, academia, law, government, technology or other areas relevant to theCompany'sCompany’s activities;•personal and professional ethics, integrity and values;•commitment to enhancing stockholder value;•ability to exercise good judgment and provide practical insights and diverse perspectives;•knowledge of the Company’s industry, markets and customers;absence of real and perceived conflicts of interest;•ability and willingness to devote sufficient time to become knowledgeable about the Company and to effectively carry out the duties and responsibilities of service;•ability to attendall or almost allBoard meetings in person;•ability to develop a good working relationship with other members of the Board; and•ability to contribute to theBoard'sBoard’s working relationship with senior management.When considering nominees, the Nominating and Corporate Governance Committee may also consider whether the candidate possesses the qualifications, experience and skills it considers appropriate in the context of the

Board'sBoard’s overall composition and needs. In addition, our Corporate Governance Principles specify that the Nominating and Corporate Governance Committee should consider the value of diversity on the Board in the director nominee identification and nomination process. Accordingly, while the Company does not have a specific policy regarding diversity, theCommittee'sNominating and Corporate Governance Committee’s evaluation of director nominees includes consideration of their ability to contribute to the diversity of personal and professional experiences, opinions, perspectives and backgrounds on the Board. Nominees are not discriminated against on the basis of race, color, religion, sex, ancestry, national origin, sexual orientation, disability or any other basis proscribed by law. The Nominating and Corporate Governance Committee will

assess the effectiveness of this approach as part of its review of the Board'sBoard’s composition as well as in the course of the Board'sBoard’s and Committee's self-evaluation process. The Nominating and Corporate Governance Committee also considers candidates for Board membership suggested by stockholders using the criteria discussed above.Committee’s self-evaluation process.

Under the heading "Proposal“Proposal No. 1. Election of Directors,"” we provide an overview of each nominee'snominee’s principal occupation, business experience and other directorships of publicly traded companies, together with the qualifications, experience, key attributes and skills the Nominating and Corporate Governance Committee and the Board believe will best serve the interests of the Board, the Company and our stockholders.

Board and Committee Self-Evaluations

The Board and each of the Audit, Compensation, and Nominating and Corporate Governance Compensation and Audit committees conduct an annual self-evaluation which includesaddressing matters the Board and committees consider relevant to their performance. These evaluations include both a qualitative and quantitative assessment by each director of the performance of the Board and the committee or committees on which the director sits. The Nominating and Corporate Governance Committee oversees the evaluation process.

Review of Board Size

As part of its annual review of the Board's size and composition, the Nominating and Corporate Governance Committee recommended to the Board an amendment to our Certificate of Incorporation to increase the maximum size of the Board from nine directors to twelve directors. Subject to stockholder approval, the Board has adopted this proposed amendment. Under the heading "Proposal No. 5. Approval of an Amendment to the MYR Group Inc. Restated Certificate of Incorporation to Increase the Maximum Size of the Board," we provide a rationale for this Board size increase and submit it for stockholder approval at the Annual Meeting.

PROPOSAL NO. 1. ELECTION OF DIRECTORS

The Board currently consists of eightnine directors. The directors are divided into three classes, designated as Class I, Class II and Class III. The term for each class expires at the conclusion of a three-year term. At the 20142016 Annual Meeting, the Class I director positionsIII directors are upstanding for election.

The Nominating and Corporate Governance Committee recommended to the Board, and the Board approved, the nomination of Henry W. FayneLarry F. Altenbaumer, William A. Koertner and Gary R. JohnsonWilliam D. Patterson as directors (the “MYR Group Nominees”), each for a term ending at the 20172019 Annual Meeting of Stockholders or until his successor has been chosen and qualified.

Each of the MYR Group Nominees was chosen by the Board to be a director because the Board and the Nominating and Corporate Governance Committee believe that his qualifications, experience, background and skills (summarized below under the subheading “Director Qualifications”), taken together, demonstrate his capacity to make a continuing meaningful contribution to the Board’s oversight of the business and affairs of the Company. Accordingly, the Board believes that the continued service of each of the MYR Group Nominees on the Board will serve the best interests of the Company and all of its stockholders.

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE ON THE

WHITE PROXY CARDFORTHE ELECTION OF LARRY F. ALTENBAUMER, WILLIAM A.

KOERTNER AND WILLIAM D. PATTERSON.

If you return aWHITE proxy card without giving specific voting instructions, then your shares will be votedFOR the election of the MYR Group Nominees.

If any nominee should be unavailable to serve due to an unanticipated event, the Board may designate another person as a substitute nominee or, in accordance with our By-Laws, act to reduce the number of directors. If the Board substitutes another nominee, the shares represented by yourWHITEproxy will be voted for the substitute nominee.

None of the nominees are related to another or to any other director or executive officer of MYR Group or its subsidiaries by blood, marriage or adoption.

THE BOARD RECOMMENDS A VOTEFORTHE ELECTION OF EACH OF THE NOMINEES.

Vote Required

On December 21, 2015, our By-laws were amended to provide for a majority standard in uncontested director elections. As amended, the By-laws provide that a director nominee in an uncontested election will be elected if the number of shares voted “for” the director’s election exceeds 50% of the number of votes cast on the issue of that director’s election (including votes FOR, AGAINST and WITHHOLD, but excluding any votes to ABSTAIN or broker non-votes). If a director in an uncontested election fails to receive the required number of votes for re-election in an uncontested election, the director is expected to tender his or her resignation effective upon the Board’s acceptance of such resignation. The Nominating and Corporate Governance Committee will act on an expedited basis to determine whether to accept the director’s resignation and will submit such recommendation for prompt consideration by the Board. A director whose resignation is under consideration is expected to abstain from participating in any decision regarding that resignation. The Nominating and Corporate Governance Committee and the Board may consider any factors they deem relevant in deciding whether to accept or reject a director’s resignation.

However, in a contested election where the number of director nominees exceeds the number of directors to be elected, a plurality vote standard will apply, and the three directors nominees who receive the most FOR votes will be elected. Because Engine Capital L.P., a Delaware limited partnership (together with its affiliates “Engine Capital”), has stated that it intends to nominate three alternative director nominees, assuming such nominees are in fact proposed for election at the Annual Meeting, the number of director nominees will exceed the number of directors to be elected. Consequently, a plurality vote standard will apply to the election of directors at the Annual Meeting.

Director Qualifications

When considering whether our directors, including the nominees, should serve as a director and have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board to satisfy its responsibilities effectively in light of our businesses and structure, the Nominating and Corporate Governance Committee and the Board considered their wealth of knowledge inof our industry and customers, integrity, their particular experiences, individual talents, business judgment and vision, leadership skills and what each individual would bring to the Board as a whole, including the information discussed in each of the director'sdirector’s individual biographies set forth in the tables below. Additionally, the Board considered and valued that each of our directors has extensive experience as a business leader and has a strong understanding of business operations in general. In particular, the Board considered that each of the directors has a strong background in the utilities sector, and the Board believes that such relevant experience is important in evaluating and overseeing our business development and strategies.

The following is information as of March 1, 2014,2016, regarding each director who is up for election at the Annual Meeting:

Age: 67 Director Since: 2006 Director Class: Class III | Mr. Altenbaumer has over 40 years of experience in the energy industry. He spent nearly 34 years at Illinois Power Company (“Illinois Power”), an electric and natural gas utility. He served as President of Illinois Power from 1999 until his retirement in 2004, and served in various financial leadership positions before that, including Treasurer, Controller and Chief Financial Officer. During his tenure with Illinois Power, Mr. Altenbaumer also served as executive Vice President for Regulated Delivery for Dynegy, Inc. (“Dynegy”), a wholesale power, capacity and ancillary service provider. Illinois Power became a subsidiary of Dynegy in 2000 in a transaction led by Mr. Altenbaumer for Illinois Power. Since 2004, Mr. Altenbaumer has served as an independent consultant, providing services to organizations both inside and outside of the energy industry. Since 2005, he has served as an independent director for the Southwest Power Pool, a FERC-approved regional transmission organization covering portions of fourteen states. Since 2014, he has served as a director for Summit Utilities, a privately-held holding company that owns and operates natural gas distribution companies in Colorado, Missouri and Maine. From 2005 to 2014, he served as an advisor to ArcLight Capital Partners, a private equity firm that has invested approximately $15.3 billion in the energy sector. He is also currently serving as the executive director of the Midwest Inland Port, a regional economic development initiative based in Decatur, Illinois and is a member of the Board of Decatur Memorial Hospital. Mr. Altenbaumer received a Bachelor’s Degree in electrical engineering and computer science from the University of Illinois. Mr. Altenbaumer serves as the chair of the Compensation committee, serves on the Nominating and Corporate Governance Committee and has a 97% attendance record for all 2015 Board and committee meetings on which he serves. |

Qualifications, Experience, Key Attributes and Skills:

Mr. Altenbaumer’s long record of achievement in various leadership positions at Illinois Power, including President, enables him to provide valuable insight into key aspects of successfully managing our day-to-day business and management operations. This experience and his current position as a director of the Southwest Power Pool and a member of its Human Resources Committee and Finance Committee support his role as Chairman of the Compensation Committee. His executive management roles, knowledge of our customers and competitors and range of consulting experience both inside and outside of the energy industry strengthen Mr. Altenbaumer’s ability to provide strategic leadership to help us better position ourselves for future growth

and success. In addition, Mr. Altenbaumer’s board service for the Southwest Power Pool along with the nature of his activity in support of several ArcLight portfolio companies provide him with relevant expertise in areas related to corporate governance issues affecting U.S. publicly traded companies and arm him with a wide base of knowledge related to his membership on the Nominating and Corporate Governance Committee.

| William A. Koertner Age: 66 Director Since: 2007 Director Class: Class III | Mr. Koertner joined MYR Group in 1998 as Senior Vice President, Treasurer and Chief Financial Officer, responsible for all financial functions including accounting, treasury, risk management and MIS operations. He was promoted to President and CEO in December 2003. Prior to joining MYR Group, Mr. Koertner served as Chief Financial Officer for Central Illinois Public Service Company from 1995 to 1998 and President and Chief Executive Officer of CIPSCO Investment Company (“CIPSCO”) from 1995 to 1998 as well. CIPSCO manages nonutility investments and provides investment management services for affiliates. Mr. Koertner holds a Bachelor of Science degree in finance from Northern Illinois University and a Masters of Business Administration degree from the University of Illinois. Mr. Koertner serves as the Chairman of the Board and has a 100% attendance record for all 2015 Board meetings. |

Qualifications, Experience, Key Attributes and Skills:

Through Mr. Koertner’s tenure as both President and CEO and Chief Financial Officer of MYR Group, he has gained an in-depth understanding of our day-to-day operations and has helped to develop and set our short and long-term growth strategies. He has been an instrumental force in building and maintaining key customer, vendor and investor relationships that have played an integral role in helping to further understand our business goals, the markets in which we operate and our competitive climate, all of which have contributed greatly to the success of the Company. Mr. Koertner also brings a wealth of financial expertise and utility background to his role and possesses an expert understanding of accounting and treasury practices, risk management and MIS operations, which allows him to provide sound guidance to the Board regarding our strategies and management.

| William D. Patterson Age: 61 Director Since: 2007 Director Class: Class III | Since 2010, Mr. Patterson has been the President of EnSTAR Management Corporation, a company that he founded to provide advisory and consulting services to utilities. From 2009 to 2010, Mr. Patterson served as Senior Vice President of Corporate and Business Development for American Water Works Company, Inc., the largest investor-owned U.S. water and wastewater utility company. From 2005 to 2008, Mr. Patterson served as Senior Vice President and Chief Financial Officer of Pennichuck Corporation, an investor-owned water utility holding company. From 2003 to 2005, he served as an executive advisor to Concentric Energy Advisors, a private firm located in Marlborough, Massachusetts, providing financial advisory and consulting services for utilities. His experience also includes nearly 20 years of work within the investment banking industry, serving in senior positions at E.F. Hutton, Shearson Lehman and Smith Barney, where he was managing director and co-head of the corporate finance department’s regulated utilities practice. Mr. Patterson earned his Bachelor of Science degree in civil engineering from Princeton University, graduating summa cum laude. He earned his Masters of Business Administration degree in finance and accounting from the University of Chicago Booth School of Business. Mr. Patterson serves as the chair of the Audit Committee, serves on the Compensation Committee and has a 100% attendance record for all 2015 Board and committee meetings on which he serves. |

Qualifications, Experience, Key Attributes and Skills

Mr. Patterson is a financial executive and expert with 30 years of experience primarily serving the regulated utility and energy/utility infrastructure markets. As Chairman of the Audit Committee and a member of the Compensation Committee, Mr. Patterson brings a broad-based track record of success as a banker, investor and advisor and has held senior management and independent director positions for both public and private companies. His service as a senior executive for various companies in the utility industry provides him with an unparalleled understanding and awareness of our markets and a valuable perspective in the review and analysis of financial statements and results.

The following is information regarding Class I and Class II directors serving as of March 1, 2016:

| Henry W. Fayne Age: 69 Director Since: 2007 Director Class: Class I Expiration of Term: 2017 | Mr. Fayne has more than 30 years of experience with American Electric Power Mr. Fayne serves on the Audit and Compensation committees and has a 91% attendance record for all 2015 Board and committee meetings on which he serves. |

Qualifications, Experience, Key Attributes and Skills:

With over 35 years of total industry experience, Mr. Fayne'sFayne’s extensive background in financial planning, budgeting, risk management and operational experience with AEP combine to provide extremely relevant insight and guidance related to our primary operations. His substantial executive leadership expertise and consulting experience are directly relevant to our operations and activities as well as to his service on our Audit and Compensation Committees, and help aid the Board'sBoard’s strategic and high-level planning as well as the Board'sBoard’s understanding of our customers and competitors. Mr. Fayne'sFayne’s participation on a variety of other boards provides him with a well-rounded perspective to further enhance the Board'sBoard’s understanding of the industry.

| Kenneth M. Hartwick Age: 53 Director Since: 2015 Director Class: Class I Expiration of Term: 2017 | In February 2015, Mr. Hartwick was named Chief Financial Officer of Wellspring Financial Corporation, a Canadian sales financing company. Prior to joining Wellspring, Mr. Hartwick served for ten years as Director, President and Chief Executive Officer of Just Energy Group Inc., an integrated retailer of commodity products. At Just Energy Group, Inc., his role included putting in place a broad set of financing arrangements for growth in North America and the United Kingdom and the expansion of the sales organization across these locations. Prior to that, Mr. Hartwick held a variety of senior executive roles, gaining an extensive financial background in the energy, consumer products and capital markets areas, including the positions of Chief Executive Officer and Chief Financial Officer at Just Energy Group, Inc., Chief Financial Officer at Hydro One, Inc. and a partner at Ernst & Young, LLP. In each of these roles, Mr. Hartwick participated in the expansion and growth of the businesses and the establishment of financial platforms to support that growth. Mr. Hartwick also serves on the Board of Directors of Atlantic Power Corporation and Spark Energy, Inc., as well as the Board of Governors for Trent University, his alma mater. Mr. Hartwick earned his Honors of Business Administration Degree from Trent University, Peterborough, Ontario and is a certified public accountant. Mr. Hartwick serves on the Audit and Nominating and Corporate Governance committees. Since his appointment in July of 2015, he has a 100% attendance record for all Board and committee meetings on which he serves. |

Qualifications, Experience, Key Attributes and Skills:

Through Mr. Hartwick’s senior executive positions, including the roles of chief executive officer and chief financial officer, he brings leadership, risk management, and strategic planning experience to the Board. Mr. Hartwick’s in-depth knowledge of financing initiatives as a senior executive in North American markets provides the Board with proficiencies to support business development, growth strategies and expenditure plans. Mr. Hartwick’s experience as a director of other publicly-traded companies enables him to provide insights into a variety of strategic planning, risk management, compensation, finance and governance practices. Mr. Hartwick’s leadership in the energy industry and financial sector make him a valued advisor and highly qualified to serve as a key member of the Board, Audit Committee, and Nominating and Corporate Governance Committee.

| Gary R. Johnson Age: Director Since: 2007 Director Class: Class I Expiration of Term: 2017 | Most recently, Mr. Johnson was Vice President and General Counsel of Xcel Energy and its wholly-owned subsidiary, Northern States Power Company. Xcel Energy, through its subsidiaries, is a leading electric and natural gas utility company offering a comprehensive portfolio of energy-related products and services to customers throughout the western and midwestern United States. Mr. Johnson occupied this position from 2000 until his retirement in 2007. From 1989 to 2000, Mr. Johnson was Vice President and General Counsel of Northern States Power Company, the predecessor to Xcel Energy. He holds a Mr. Johnson is the Board’s Lead Director. He serves on the Compensation and Nominating and Corporate Governance committees and has a 100% attendance record for all 2015 Board and committee meetings on which he serves. |

Qualifications, Experience, Key Attributes and Skills:

Through his distinguished career as an executive officer and general counsel at Xcel Energy and Northern States Power Company, Mr. Johnson gained a broad understanding of the business, industry, legal issues and regulatory landscape of the electrical utility industry. Serving as Lead Director on the Board and the Chairman of the Nominating and Corporate Governance Committee, Mr. Johnson uses his vast knowledge to provide a valuable perspective that assists the Board in its understanding of current legal and regulatory issues facing us and the industry.

The following is information regarding Class II and Class III directors serving as of March 1, 2014:

| Jack L. Alexander Age: Director Since: 2007 Director Class: Class II Expiration of Term: | Mr. Alexander retired from MidAmerican Energy Company Mr. Alexander serves on the Audit and Compensation committees and has a 100% attendance record for all 2015 Board and committee meetings on which he serves. |

Qualifications, Experience, Key Attributes and Skills:

Mr. Alexander'sAlexander’s background as a senior executive at MidAmerican and varied industry experience in transmission and distribution, electric generation, energy trading, marketing and sales, risk management, legislation and regulation, engineering, corporate planning and human resources provide him with an extremely broad and fundamental understanding related to our operations and organizational structure, our utility customers and our transmission and distribution business sector. He also has extensive experience with mergers and acquisitions including asset valuations and due diligence on a number of utility acquisitions. His knowledge and experience is extremely relevant to Mr. Alexander'sAlexander’s role as a member on the Audit Committee. While at MidAmerican, Mr. Alexander was responsible for the construction of over $2.0 billion of new electric generation in the state of Iowa including one of the world'sworld’s largest land-based wind energy projects. He also has experience serving as MidAmerican'sMidAmerican’s chief company spokesperson on a number of IBEW labor contract negotiations. His human resources leadership and experience in labor relations, contract negotiations, compensation and benefits, employment and employee development and training provide a unique and thorough perspective that is of great value in Mr. Alexander'sAlexander’s role on our Compensation Committee.

Age: Director Since: Director Class: Class II Expiration of Term: | Mr. Lucky serves on the Compensation and Nominating and Corporate Governance committees. Since his appointment in July of 2015, he has a 100% attendance record for all Board and committee meetings on which he serves. |

Qualifications, Experience, Key Attributes and Skills:

Ms. Johnson's experienceThroughout his career as an attorney in the construction industry, Mr. Lucky has a financial officer at a variety of companies as well as her construction background, including her employment with us, anddetailed understanding of financethe legal issues and accounting, risk auditing, internal controls and procedures for financial reporting processes for large publicly traded corporations provide her with a strong foundational understandingrisks of our financial requirementscurrent and expanding markets. Mr. Lucky’s perspective as well asan academic and his involvement in various energy projects in multiple countries provides the financialBoard with valuable new ideas and perspectives. Mr. Lucky’s experience in the construction industry with the wealth of knowledge he has gained advocating for contractors gives the Board significant insight for our strategic planning while presenting the Board an understanding and awareness of the opportunities and challenges and issues facingthat present the Company, industry and market. This combination of background and experience ideally positions Ms. Johnson as a key member on both our Audit and Nominating and Corporate Governance Committees.Company.

| Maurice E. Moore Age: Director Since: 2010 Director Class: Class II Expiration of Term: | Since 2009, Mr. Moore has been Managing Director and sole proprietor of Primus Financial Group, LLC, a firm providing leasing and project finance advisory services to companies engaged in the renewable energy business. With more than 25 years of professional financial experience, Mr. Moore has an extensive background in originating, negotiating, syndicating and financing large capital projects in various business segments, including the electric utility and renewable energy industries. Prior to his position at Primus Financial Group, Mr. Moore served in senior leadership roles with Chase Equipment Leasing, Inc. from 2006 to 2009, a division of JP Morgan Chase offering a variety of financing and lease solutions to help businesses acquire the equipment needed for daily operations; and JP Morgan Capital Corporation, and its predecessor companies, from 1986 to 2005. Prior to serving on the Board, Mr. Moore served on the boards for West Suburban Medical Center and Community Chest of Oak Park & River Forest, Illinois, and was formerly Finance Advisory Committee Chairman for Oak Park & River Forest High School in Illinois. Mr. Moore earned a Bachelor of Science degree in civil engineering from Brown University and a Masters of Business Administration degree from Harvard Mr. Moore serves on the Audit and Nominating and Corporate Governance committees and has a 96% attendance record for all 2015 Board and committee meetings on which he serves. |

Qualifications, Experience, Key Attributes and Skills:

Mr. Moore has substantial leadership, financial services and capital expenditures experience, and has advised a variety of clients engaged in energy and renewable energy markets. His skills in originating, negotiating and financing large capital projects in both similar and varying environments serve as a guiding force concerning our capital investment and expenditure plans. In addition, his

financial advisory involvement in the renewable energy space provides a diverse range of insight that contributes to the Board'sBoard’s understanding of the markets in which we operate. Mr. Moore'sMoore’s business acumen and participation on the Audit and Nominating and Corporate Governance Committees help to broaden our exposure and understanding of successful financial practices and growth strategies.

BACKGROUND OF SOLICITATION

On November 20, 2015, Arnaud Ajdler, Managing Partner of Engine Capital, spoke with William A. Koertner, the Company’s Chairman, President and CEO, and Richard S. Swartz, Jr., the Company’s Senior Vice President and Chief Operating Officer, by phone. Messrs. Koertner and Swartz believed this call to be a typical investor call with an institutional shareholder. As part of the discussion, Mr. Ajdler asked general questions about the Company’s business and industry outlook. The discussion then turned to the Company’s stock performance, and Mr. Ajdler inquired about why the Company was not returning capital to stockholders or considering selling itself. As Messrs. Koertner and Swartz discussed these issues with Mr. Ajdler, they developed the sense, based on Mr. Ajdler’s responses and reactions, that Mr. Ajdler was not interested in a dialogue on these issues, but rather advocating for these actions. Messrs. Koertner and Swartz also noted that Mr. Ajdler did not assign any risk to the disruptive effect that a price discovery process could potentially have on the Company, nor did he see any merit in waiting for any market recovery before initiating a price discovery process. During this conversation, Mr. Arnaud made no mention of communicating with the Board or of any intention to nominate directors.

On December 8, 2015, the Board received a letter from Engine Capital (the “December 8 Letter”) recommending that the Company take certain corporate actions including, among other things, undertaking an evaluation of a sale of the Company or a levered recapitalization of the Company, with the proceeds used to fund a one-time large special dividend to shareholders or a large tender offer, and a change in future capital allocation. The December 8 Letter also notified the Board that Engine Capital planned to nominate directors at the Annual Meeting prior to the nomination deadline. Engine Capital filed the December 8 Letter with the SEC on December 9, 2015.

After receipt of the December 8 Letter, the Company engaged an investment banking firm to assist the Company and the Board in the evaluation of strategic alternatives, which included the suggestions included in the December 8 Letter.

On December 15, 2015, Mr. Koertner received an e-mail from Mr. Ajdler (the “December 15 E-Mail”), in which Mr. Ajdler claimed to have communicated with many of the Company’s stockholders about the Company’s performance and the December 8 Letter. The e-mail also indicated that Engine Capital is “aware of strategic buyers as well as private equity firms that have an interest in [MYR Group] but don’t want to do the first move and are waiting for the company to start a process,” though the e-mail failed to identify specifically any parties who had purportedly expressed such interest. The e-mail also reiterated Engine Capital’s intent to nominate directors to the Board once the nomination window opened.

On January 5, 2016, the Company published investor presentation materials on its website and filed the investor presentation materials with the SEC.

On January 6, 2016, at the beginning of the nomination window specified in the Company’s By-Laws, the Company received a letter from Engine Capital notifying the Company of Engine Capital’s intention to nominate Mr. Ajdler, Grant C. McCullagh and John P. Schauerman for election to the Board at the Annual Meeting. The letter also indicated that, as of the date of the letter, Engine Capital beneficially owned in the aggregate 956,690 shares of the Company’s common stock. Exhibit A to the letter, which lists Engine Capital’s transactions in the Company’s securities during the last two years, indicates that Engine Capital acquired these shares between the months of November and December, 2015.

On January 7, 2016, Mr. Koertner received an e-mail from Mr. Ajdler, in which Mr. Ajdler, among other things, reiterated his views from the December 15 E-Mail, and notified Mr. Koertner of Engine Capital’s plan to issue a press release announcing Mr. Ajdler, Mr. McCullagh and Mr. Schauerman as Engine Capital’s slate of director nominees. Later that same day, Engine Capital issued the press release and filed it with the SEC.

On January 16, 2016, representatives of the Company sent the Company’s D&O Questionnaire, which is required to be completed by all members of the Board and nominees to the Board, to Engine Capital’s representatives, so that Engine Capital’s proposed director nominees could complete the questionnaire and be evaluated by the Board in the same manner that the Board evaluates its own nominees in accordance with the Board’s Corporate Governance Principles. In e-mail communications exchanged between representatives of Engine Capital and representatives of the Company between January 19, 2016 and January 29, 2016,

representatives of Engine Capital responded that, because there is no express requirement in the Company’s By-Laws, Engine Capital’s nominees would not complete the D&O Questionnaire, despite the Board’s practices and express policies to evaluate all nominees in the same manner. On January 20, 2016, Mr. Koertner and Kenneth M. Hartwick, an independent |

Qualifications, Experience, Key Attributes and Skills:

Mr. Altenbaumer's long record of achievement in various leadership positions at Illinois Power, including President, enables him to provide valuable insight into key aspects of successfully managing our day-to-day business and management operations. This experience and his current position as a director of the Southwest Power PoolBoard and a member of its Human Resources Committee and Finance Committee support his role as Chairman of the Compensation Committee. His executive management roles and range of consulting experience both inside and outside of the industry strengthen Mr. Altenbaumer's ability to provide strategic leadership to help us better position ourselves for future growth and success. In addition, Mr. Altenbaumer's board service for the Southwest Power Pool along with the nature of his activity in support of several ArcLight portfolio companies provide him with relevant expertise in areas related to corporate governance issues affecting U.S. publicly traded companies and arm him with a wide base of knowledge related to his membership on theBoard’s Nominating and Corporate Governance Committee.

TableCommittee, met with Mr. Ajdler. The purpose of Contents

Qualifications, Experience, Key Attributes and Skills:

Through Mr. Koertner's tenure as both President and CEO and Chief Financial Officer of MYR Group, he has gained an in-depth understanding of our day-to-day operations and has helped to develop and set our short- and long-term growth strategies. He has been an instrumental forcelisten to Engine Capital’s views raised in building and maintaining key customer, vendor and investor relationships that have played an integral role in helping to further understand our business goals, the markets in which we operate and our competitive climate, all of which have contributed greatlyits prior communications to the successCompany. As part of the discussion, Messrs. Koertner and Hartwick requested additional information to better understand the basis of Engine Capital’s claim that the Company “could easily carry leverage up to 3x EBITDA and still have plenty of bonding capacity,” but Mr. Ajdler refused to provide any information to support this claim. In addition, Messrs. Koertner and Hartwick discussed with Mr. Ajdler Engine Capital’s views on running a price discovery process for the Company. Mr. Ajdler expressed the view that there would be zero downside to running a price-discovery process. Messrs. Koertner and Hartwick also bringsrequested information about the companies or private equity firms that Engine Capital claimed had contacted it to express an interest in acquiring the Company. Again, Mr. Ajdler would not identify any company or private equity fund that had purportedly communicated any such interest.

On January 20, 2016, the Board held a wealth of financial expertise and utility background to his role and possesses an expert understanding of accounting and treasury practices, riskspecial meeting via teleconference with management and MIS operations,Company advisors to discuss the meeting between Messrs. Koertner and Hartwick with Mr. Ajdler earlier the same day.

On January 25, 2016, Mr. Ajdler sent an e-mail to Mr. Hartwick, in which allows himhe continued to provide sound guidanceadvocate for a sale of the Company.

On February 4, 2016, the Board convened a regularly scheduled meeting. At the meeting, the Board discussed the Company’s forecast update and capital budget and reviewed the Company’s capital structure and certain strategic alternatives with management and Company legal and financial advisors. Following these discussions, the Board determined that it would be in the best interests of the Company and its shareholders to authorize a $75 million increase to the Company’s existing $67.5 million share repurchase program, as well as to approve new financing strategies to support the Company’s future equipment needs. In addition, the Board reviewed Engine Capital’s statements and requests and explored options in order to reach an agreement with Engine Capital without the distraction and expense of a proxy contest. The Board authorized Company management to contact representatives of Engine Capital in order to propose a solution that provided Engine Capital the right to designate a nominee for election to the Board.

On February 5, 2016, representatives of the Company contacted representatives of Engine Capital by telephone to discuss entering into a mutual confidentiality agreement so that the Company and Engine Capital could discuss a settlement and avoid a costly proxy contest. Shortly thereafter, representatives of the Company sent a confidentiality agreement to representatives of Engine Capital. Other than a query on February 5, 2016, to clarify a term in the confidentiality agreement, Engine Capital and its representatives did not respond to the proposed confidentiality agreement until February 8, 2016, when Engine Capital’s representatives proposed certain minor revisions to the confidentiality agreement, which the Company agreed to accept.

On February 8, 2016, Engine Capital and the Company entered into a confidentiality agreement so that they could begin discussing settlement terms. Shortly thereafter, Company representatives had a call with representatives of Engine Capital to discuss the Company’s offer to enter into an agreement that would include the addition of one of Engine Capital’s director nominees or one mutually agreed independent nominee should customary screening by the Board’s Nominating and Corporate Governance Committee determine that the Engine Capital nominees did not satisfy the criteria for service on the Board. Engine Capital rejected the Company’s offer and demanded that the Company appoint two of Engine Capital’s nominees to the Board regarding our strategies and management.

Qualifications, Experience, Key Attributes and Skills

Mr. Patterson isthat the Company publicly announce a financial executive and expert with 30 years of experience primarily servingprice discovery process for the regulated utility and energy/utility infrastructure markets. As an independent director and Chairmanpotential sale of the Audit CommitteeCompany.

On February 9, 2016, the Company issued a press release announcing the $75 million increase to its existing share repurchase program and a memberthe Company’s new financing strategies. In addition, the Company disclosed Engine Capital’s rejection of the Compensation Committee, Mr. Patterson bringsCompany’s offer.

On February 16, 2016, Engine Capital issued a broad-press release expressing its views regarding the Company’s announced expansion of its share repurchase program and its new financing strategies. In addition, Engine Capital continued to advocate for a sale of the Company.

based track record of success as a banker, investor and advisor and has held senior management and independent director positions for both public and private companies. His service as a senior executive for various companies in the utility industry provides him with an unparalleled understanding and awareness of our markets and a valuable perspective in the review and analysis of financial statements and results.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"“Exchange Act”), requires our executive officers, directors and persons who own more than 10% of our common stock to report their ownership of our common stock and changes in that ownership.

We reviewed copies of reports filed pursuant to Section 16(a) of the Exchange Act and written representations from reporting persons that all reportable transactions were reported. Based solely on that review, we believe that during the fiscal year ended December 31, 2013,2015, all filings required filingsof our executive officers and directors were timely made in accordance with the Exchange Act requirements.Act.

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

Review, Approval and Ratification of Transactions with Related Persons

We have a written policy and procedures for the review, approval and ratification of transactions with related persons, which hashave been adopted by the Board. Under our policy, the definition of related persons includes, among others, our namedany person who is or was, during the last fiscal year, an executive officers, directors, beneficial ownersofficer, director or nominee for director of the Company, any shareholder owning more than 5% of any class of our common stock andvoting securities, or an immediate family member of any such person.

It is the policy of the foregoing person's immediate family members. In consideringCompany to prohibit related person transactions unless the approval of any related party transaction, theCompany’s Audit Committee will consider whether or not the termshas determined in advance of the Company or a subsidiary entering into the transaction that it will be conducted on terms that are fair to the Company.Company or the subsidiary and the transaction is in the best interests of the Company or the subsidiary.

Pursuant to our policy, there were no reported transactions in 20132015 that qualified as a related person transaction, and thereforetransaction. As a result, no reported transaction was referred to the Audit Committee or any other committee of the Board for review.review and no related person transaction was required to be disclosed in the Company’s filings.

COMPENSATION COMMITTEE MATTERS

The Board established the standing Compensation Committee in accordance with our By-Laws. The Board has determined that each member of the Compensation Committee qualifies as an "independent"“independent” director as defined under the Nasdaq rules, as a "non-employee director"“non-employee director” as defined in Rule 16b-3(b)(3) under the Exchange Act and as an "outside director"“outside director” within the meaning of Section 162(m)(4)(C)(i) of the Internal Revenue Code of 1986, as amended (the "IRS Code"“IRS Code”).

The Compensation Committee firmly believes that the compensation of our executive officers should emphasize paying for performance that contributes to our success while encouraging behavior that is in our and our stockholders',stockholders’ long-term best interests. The Compensation Committee is responsible for assisting the Board in overseeing the Company'sCompany’s compensation and employee benefit plans and practices, including its executive compensation plans and its incentive-compensation and equity-based plans. To represent and assist the Board in its oversight of the Company'sCompany’s compensation practices and under its charter, the Compensation Committee performs, among other tasks,others, the following duties:tasks:

•- reviews and recommends changes to the

Company'sCompany’s executive compensation philosophy, general compensation programs and executive benefit plans, including incentive-compensation programs and equity-based plans;•reviews and recommends any changes to the goals and objectives of theCompany'sCompany’s executive compensation plans;•reviews and recommends any changes to the Company's executive compensation plans in light of the Company's goals and objectives with respect to such plans;•evaluates annually the performance of named executive officers in light of the goals and objectives of theCompany'sCompany’s executive compensation plans, and determines and approves, or recommends to the Board for its approval, the compensation levels of named executive officers based on this evaluation;•evaluatesannuallythe appropriate level of compensation for Board andCommitteecommittee service by non-employee members of theBoard;Board and•- determines and approves, or recommends to the Board for its approval, the level of compensation for such service;

establishes and reviews stock ownership guidelines for directors andofficers.officers; andreviews and recommends to the Board the frequency with which the Company will conduct Say-on-Pay Votes and reviews and approves proposals regarding the Say-on-Pay Vote and the frequency of the Say-on-Pay Vote to be included in the Company’s proxy statement.The Compensation Discussion and Analysis, included in this Proxy Statement, goes into further detail about the Compensation

Committee'sCommittee’s processes for determining the appropriate levels of compensation for executive officers and directors.Compensation Consultants

In order to fulfill its duties, the Compensation Committee has the authority to retain, at the

Company'sCompany’s expense, its own advisors and compensation consultants and to approve their compensation. These external compensation consultants provide the Compensation Committee with guidance on compensation trends, program designs and market research and advice and recommendations on both executive and director compensation. They also help evaluate the competitive position of named executiveofficers'officers’ anddirectors'directors’ compensation, and provide advice on incentive award programs. Their findings are discussed in more detail in the Compensation Discussion and Analysis.Compensation consultants are engaged by and report directly to the Compensation Committee on executive compensation matters and meet separately with the Compensation Committee outside the presence of management. Interaction between the compensation consultants and management is generally limited to providing necessary information and data.

Since November 2009, theThe Compensation Committee has retained Mercer to serve as its compensation consultant. The Compensation Committee has reviewed the independence ofMercer'sMercer’s advisory role relative to the six consultant independence factors adopted by the SEC to guide listed companies in determining the independence of their compensation consultants, legal counsel and other advisers. Following its review, the

Compensation Committee concluded that Mercer has no conflicts of interest, and provides the Compensation Committee with objective and independent executive compensation advisory services.

Compensation Risk Assessment

In reviewing and approving compensation programs, the Compensation Committee considers whether the programs are likely to promote risk-taking behavior that could adversely affect the Company. The Compensation Committee has designed the Company'sCompany’s compensation programs, including the Company'sCompany’s incentive compensation plans, with specific features to address potential risks while rewarding employees for achieving long-term financial and strategic objectives through prudent business judgment and appropriate risk taking. The following elements have been incorporated into our programs available for our executive officers:

•• A Balanced Mix of Compensation Components—The target compensation mix for the Company'sCompany’s executive officers is composed of salary, annual cash incentives and long-term equity incentives, representing a mix that is not overly weighted toward short-term cash incentives.• Multiple Performance Factors—The Company'sCompany’s incentive compensation plans use multiple Company-wide metrics, which encourage retention of executives and focus on the achievement of objectives for the overall benefit of theCompany:•- Company. The